Feb 11, 2019

There is a lot of concern with income and wealth inequality. It has increased considerably since about 1980. I am against it, and so is everyone I know. Very few people seem to know the cause, so mostly one hears remedies based on folk tales and superstition, often motivated by political bias. I offer what I consider to be the best theory - one that both explains the diversion operationally, and satisfies the timing of it.

The Left wants more welfare, better schools, free college, enhanced job training, and more. The Right, in contrast, wants welfare reform, charter schools, tax reform ... and use of the negative income tax. Both sides get it wrong. Neither side understands economic inequality, nor what causes it to change. - Mark Thornton [1]

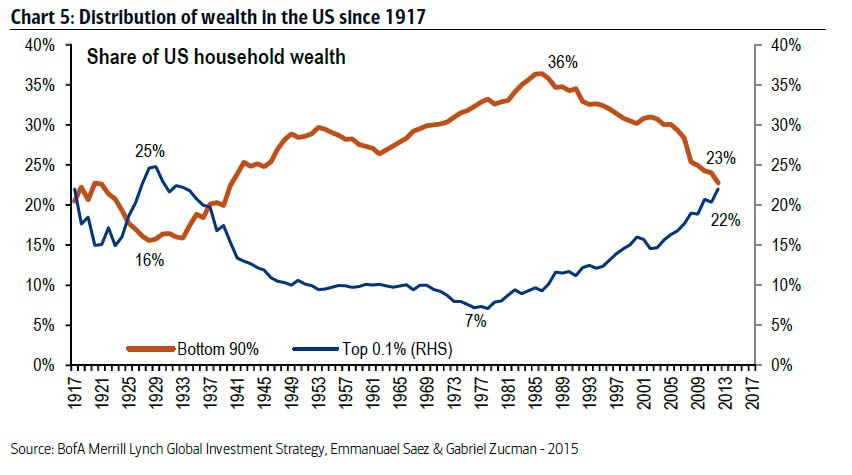

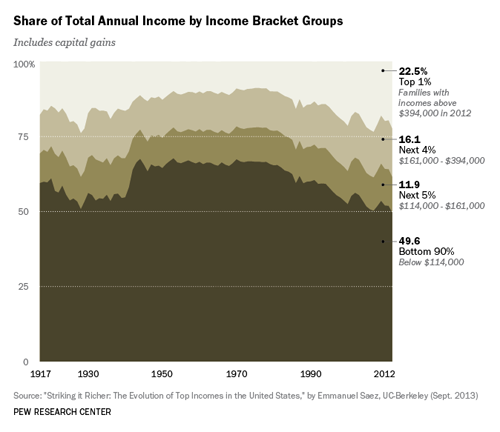

Income and wealth inequality is mainly the result of fiat money, in particular the fiat status of the US dollar since 1971. That is why the top .1% and the lower 90% started diverging to an unprecedented degree starting around 1980.

Here’s how it happened. After 1971, the US State, for the first time, could create money out of thin air. Why? The US dollar had become the world monetary standard after WWII, as the British pound had been, and the Spanish dollar before that. When a government can create money out of thin air, it tends to engage in military interventionism, since it can pay the costs with paper rather than having to tax people. It can keep military outposts and bases all around the world. It can control vassal States, and even engage in regime change.

This is called “monetary hegemony.” Monetary hegemony refers to the fact that, historically, one currency has often enjoyed a dominant market share worldwide (or in the known world for e.g. Greek and Roman times.) Today, we would call this a network effect, e.g. the same reason Facebook became dominant in social media in the US. During the Roman Empire, the denarius was the “world” standard. In more modern times, the Spanish Empire, with its gold and silver looting/mining from the Americas, saw the Spanish Dollar (silver unbroken “piece of eight” from pirate tales) the world standard. When the British Empire became dominant, the British pound became the first truly world currency, as it was used in India and China trade.

Having the largest market share - monetary hegemony - has its advantages. Since other countries are, from a domestic perspective, hoarding it, more paper can be printed than actual silver (or gold) backing. So far, all currencies have been at least in theory redeemable for commodities. So even though the State enjoying monetary hegemony cheated by printing notes without backing, they could get away with it only to a moderate degree, and only to the extent that other countries used it for foreign trade and banking reserves. Call this constrained monetary fraud, since there was a promise to redeem the notes, and they did (usually) redeem the notes, but there were obviously more notes circulating than gold backing in the vault.

What happens when the monetary hegemon openly says, “From now on, we will not redeem our notes for gold.”? That had never happened until 1971, when (as the euphemism goes) Nixon “closed the gold window.” Put more plainly, Nixon declared that the US reneged on the Bretton Woods treaty, and would no longer redeem US dollars as agreed. Put bluntly, the US declared bankruptcy.

What happened was surprising. The winners of World War II, the Anglo-American Empire and its vassal States in Europe, chose to continue as if nothing had happened, even though economists warned that a fiat money regime is unsustainable. The rulers’ incentive to print money is too great. All fiat currencies go bust, most often due to hyper-inflation.

The US is about on schedule. Even US intelligence services are aware of the coming end of dollar hegemony (and milking it as a military threat to pour plundered wealth into, of course.) The US establishment generally would prefer to see World Bank SDRs (Special Drawing Rights) replace the US dollar. China would love to take their turn, and have a fiat yuan replace the dollar, so they can have navies and soldiers all over the world. Turn about. But maybe not. China (and India and Russia) are hoarding gold and unloading dollars. Some of the smarter Chinese economists want to have a gold-backed yuan, or perhaps a gold-backed BRICS international currency.

The end of US dollar hegemony is nigh, and Trump is doing all he can (accidentally and inadvertently) to speed up the end of the dollar. For example, he weaponized the SWIFT international trading system to punish firms that trade with States he hates. He punishes sanctions violators by not letting them exchange using SWIFT. That is very short-range thinking, since that simply sped up the creation of non-dollar alternatives. China and Russia have set up an alternative system already. Not to mention the boost to crypto-currency solutions.

A monetary hegemon is unconstrained in its inflation of its currency, but all other States today are constrained by the US dollar (and gold) reserves in their central bank. So Costa Rica holds dollars in its vault, and prints up Colones, kind of pyramiding on the dollar. Same for China, which is why China can’t inflate as much. China tries to maintain a fixed rate of exchange between the yuan and dollar.

In the long run, fiat money is unsustainable, since it is unbacked; Rulers have an incentive to inflate the money supply, i.e. debase the currency.

How do the rulers distribute the new money? Through direct payments (to e.g. the military industrial complex) and through the banking cartel. The US State distributes money to crony banks through its cartel enforcement agency, the Federal Reserve Bank.

Who do the cartel banks distribute the new money to, in turn? Wealthy borrowers. Through lending. The banks do not generally lend out the money to poor people. Surprise!

But who are the first receivers of the new money in our fiat money system? Those who want to benefit from the new money must receive it where it is produced, namely in the banking system in form of a loan. And in order to get a loan from a bank it is helpful to be rich. Rich people owning large amounts of assets such as stocks or real estate may pledge their stocks or real estate as a guarantee for new loans. They may then use these loans to acquire even more stocks and real estate that, in consequence, keep rising in value. - Philipp Bagus [2]

The Cantillon Effect is a well-known economic fact: The people closest to the money "spigot" get the biggest benefits, and the people far away from the spigot are screwed. Why? The early birds get the currency before prices have been bid up. The late birds pay inflated prices long before the money trickles down to them.

Money production creates winners and losers. The winners are those who can use the new money first, because at this point in time the money prices of the other goods are still relatively low. Due to these expenditures, prices and incomes gradually increase, and in this way the new money spreads through the economy. The losers of this process are those who only later — or last of all — enjoy a higher money income. This is because they are already having to pay the higher prices, created by the increased money expenditure of the early users of the new money, out of their previous lower income. - Jörg Guido Hülsmann [3]

This Fiat US Dollar theory explains the divergence in income that began around 1980. I have examined alternative explanations of income/wealth inequality, and found them wanting. Some do not jibe with the timeline - the divergence starting about 1980. Robert Reich's explanation, that Reagan tax cuts caused the divergence, does at least satisfy the timeline, but fails because actual payments by the 1% (and revenue to the State) did not increase. That seems to bust his theory.

Now that we know the cause of income and wealth inequality, the cure is obvious. We need to adopt money that cannot be debased or manipulate by ruling elites. Fortunately for we the people, we have free market money on the horizon - crypto currencies of various sorts - and most likely we will have several brands of decentralized commodity backed crypto currencies in the near future. Certainly they will get a major boost when the dollar hyper-inflates and dies.

Another, remote but conceivable possibility is that rulers of one or more States will, against their own interests, resort to a commodity-backed currency. The Chinese yuan and/or a future BRICS currency might be backed by gold, but private crypto-currencies backed by silver, gold, kilowatt hours, or cannabis are more likely to prevail. When the dollar goes to shit, look for an Apple-Walmart digital currency backed by one ounce Silver Sams. Or something like that.

[1] Gold and Economic Inequality, Mark Thornton

[2] How monetary inflation increases inequality, Philipp Bagus

[3] How Money Production Can Worsen Income Inequality, Jörg Guido Hülsmann